The e-commerce logistics market is a part of the global air freight and logistics market within the global transportation market. Apart from the market in focus, Technavio’s market analysis reports also provide in-depth coverage of the external factors influencing the parent market growth potential in the coming years.

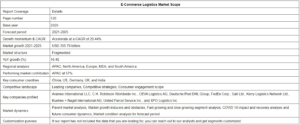

In this report, Technavio defines 2020 as the base year and 2021-2025 as the forecast period. The size of the e-commerce logistics market is anticipated to grow by USD 355.79 billion from 2020 to 2025. Moreover, the growth momentum of the market will accelerate at a CAGR of 20.44% during the forecast period. Our report describes in detail the various factors that are responsible for the market growth and the growth momentum.

Find additional market insights by Technavio to help your organization foster innovation and make effective decisions. View our Exclusive Sample Report

What are the Some of the Topics Covered in this Report?

- Overview of the Market

- Market Sizing

- Five Forces Analysis

- Market Segmentation

- Factors Impacting Market Growth

- Vendor Analysis

We offer customization at the time of purchase. Speak to our analyst to gain access to a customized report based on your requirements

What are the Various Segments Covered in this Report?

|

Segmentation |

Segments |

|

Service |

Transportation, warehousing, and others |

|

Geography |

APAC, North America, Europe, Middle East and Africa, and South America |

What are the Factors Driving the Growth of the E-Commerce Logistics Market?

The growth of the e-commerce logistics market will be driven by the increase in cross-border e-commerce activities. The rise in per capita income and the growing accessibility to foreign brands are leading to the preference for cross-border e-commerce. Trade corridors facilitate trading and promote economic development between geographic regions. Logistics plays a major role in cross-border e-commerce.

What are the Trends Supporting the Growth of the E-Commerce Logistics Market?

The emergence of supermarket mini distribution centers is one of the key trends in the e-commerce logistics market. Shippers are moving storage and manufacturing closer to consumers owing to the growing demand for faster order fulfillment. This helps in speeding up the delivery process. As a large number of supermarkets and stores have started to act as mini distribution centers, e-commerce logistics are expected to become more efficient in the future.

Technavio helps businesses keep up with the key trends in the market. Download an Exclusive Sample Report

Which are the Major Vendors Operating in the E-Commerce Logistics Market?

According to Technavio, the major vendors operating in the e-commerce logistics market include Aramex International LLC, C.H. Robinson Worldwide Inc., CEVA Logistics AG, Deutsche Post DHL Group, FedEx Corp., Gati Ltd., Kerry Logistics Network Ltd., Kuehne + Nagel International AG, United Parcel Service Inc., and XPO Logistics Inc. among others.

Is the Market Fragmented or Concentrated?

The e-commerce logistics market is fragmented, and the vendors are deploying growth strategies such as innovative solutions and M&A to compete in the market. The major vendors in the market compete on various parameters, such as providing innovative solutions like fulfillment centers closer to the customer location.

Does Technavio Provide Any Subscription Offers?

Technavio provides two subscription offers, a Basic Plan billed annually at USD 5000 and a Team Plan billed annually at USD 8500. Choose any offer that is the most suitable for you and make use of the vast repository of reports offered by Technavio to improve your business!

Related Reports

Cross-border E-commerce Logistics Market by Service and Geography – Forecast and Analysis 2022-2026

Logistics Market by End-user and Geography – Forecast and Analysis 2022-2026

Table of Contents

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value chain analysis: Air freight and logistics market

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.3 Market size 2020

- 3.4 Market outlook: Forecast for 2020 – 2025

- Exhibit 06: Global – Market size and forecast 2020 – 2025 ($ billion)

- Exhibit 07: Global market: Year-over-year growth 2020 – 2025 (%)

4 Five Forces Analysis

- 4.1 Five Forces Summary

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition – Five forces 2020

5 Market Segmentation by Service

- 5.1 Market segments

- Exhibit 15: Service – Market share 2020-2025 (%)

- 5.2 Comparison by Service

- Exhibit 16: Comparison by Service

- 5.3 Transportation – Market size and forecast 2020-2025

- Exhibit 17: Transportation – Market size and forecast 2020-2025 ($ billion)

- Exhibit 18: Transportation – Year-over-year growth 2020-2025 (%)

- 5.4 Warehousing – Market size and forecast 2020-2025

- Exhibit 19: Warehousing – Market size and forecast 2020-2025 ($ billion)

- Exhibit 20: Warehousing – Year-over-year growth 2020-2025 (%)

- 5.5 Others – Market size and forecast 2020-2025

- Exhibit 21: Others – Market size and forecast 2020-2025 ($ billion)

- Exhibit 22: Others – Year-over-year growth 2020-2025 (%)

- 5.6 Market opportunity by Service

- Exhibit 23: Market opportunity by Service

6 Customer landscape

7 Geographic Landscape

- 7.1 Geographic segmentation

- Exhibit 25: Market share by geography 2020-2025 (%)

- 7.2 Geographic comparison

- Exhibit 26: Geographic comparison

- 7.3 APAC – Market size and forecast 2020-2025

- Exhibit 27: APAC – Market size and forecast 2020-2025 ($ billion)

- Exhibit 28: APAC – Year-over-year growth 2020-2025 (%)

- 7.4 North America – Market size and forecast 2020-2025

- Exhibit 29: North America – Market size and forecast 2020-2025 ($ billion)

- Exhibit 30: North America – Year-over-year growth 2020-2025 (%)

- 7.5 Europe – Market size and forecast 2020-2025

- Exhibit 31: Europe – Market size and forecast 2020-2025 ($ billion)

- Exhibit 32: Europe – Year-over-year growth 2020-2025 (%)

- 7.6 MEA – Market size and forecast 2020-2025

- Exhibit 33: MEA – Market size and forecast 2020-2025 ($ billion)

- Exhibit 34: MEA – Year-over-year growth 2020-2025 (%)

- 7.7 South America – Market size and forecast 2020-2025

- Exhibit 35: South America – Market size and forecast 2020-2025 ($ billion)

- Exhibit 36: South America – Year-over-year growth 2020-2025 (%)

- 7.8 Key leading countries

- Exhibit 37: Key leading countries

- 7.9 Market opportunity by geography

- Exhibit 38: Market opportunity by geography

8 Drivers, Challenges, and Trends

- 8.1 Market drivers

- 8.2 Market challenges

- Exhibit 39: Impact of drivers and challenges

- 8.3 Market trends

9 Vendor Landscape

- 9.1 Overview

- 9.2 Vendor landscape

- Exhibit 40: Vendor landscape

- 9.3 Landscape disruption

- Exhibit 41: Landscape disruption

- Exhibit 42: Industry risks

10 Vendor Analysis

- 10.1 Vendors covered

- Exhibit 43: Vendors covered

- 10.2 Market positioning of vendors

- Exhibit 44: Market positioning of vendors

- 10.3 Aramex International LLC

- Exhibit 45: Aramex International LLC – Overview

- Exhibit 46: Aramex International LLC – Business segments

- Exhibit 47: Aramex International LLC – Key news

- Exhibit 48: Aramex International LLC – Key offerings

- Exhibit 49: Aramex International LLC – Segment focus

- 10.4 C.H. Robinson Worldwide Inc.

- Exhibit 50: C.H. Robinson Worldwide Inc. – Overview

- Exhibit 51: C.H. Robinson Worldwide Inc. – Business segments

- Exhibit 52: C.H. Robinson Worldwide Inc. – Key news

- Exhibit 53: C.H. Robinson Worldwide Inc. – Key offerings

- Exhibit 54: C.H. Robinson Worldwide Inc. – Segment focus

- 10.5 CEVA Logistics AG

- Exhibit 55: CEVA Logistics AG – Overview

- Exhibit 56: CEVA Logistics AG – Business segments

- Exhibit 57: CEVA Logistics AG – Key news

- Exhibit 58: CEVA Logistics AG – Key offerings

- Exhibit 59: CEVA Logistics AG – Segment focus

- 10.6 Deutsche Post DHL Group

- Exhibit 60: Deutsche Post DHL Group – Overview

- Exhibit 61: Deutsche Post DHL Group – Business segments

- Exhibit 62: Deutsche Post DHL Group – Key news

- Exhibit 63: Deutsche Post DHL Group – Key offerings

- Exhibit 64: Deutsche Post DHL Group – Segment focus

- 10.7 FedEx Corp.

- Exhibit 65: FedEx Corp. – Overview

- Exhibit 66: FedEx Corp. – Business segments

- Exhibit 67: FedEx Corp. – Key offerings

- Exhibit 68: FedEx Corp. – Segment focus

- 10.8 Gati Ltd.

- Exhibit 69: Gati Ltd. – Overview

- Exhibit 70: Gati Ltd. – Business segments

- Exhibit 71: Gati Ltd. – Key news

- Exhibit 72: Gati Ltd. – Key offerings

- Exhibit 73: Gati Ltd. – Segment focus

- 10.9 Kerry Logistics Network Ltd.

- Exhibit 74: Kerry Logistics Network Ltd. – Overview

- Exhibit 75: Kerry Logistics Network Ltd. – Business segments

- Exhibit 76: Kerry Logistics Network Ltd.- Key news

- Exhibit 77: Kerry Logistics Network Ltd. – Key offerings

- Exhibit 78: Kerry Logistics Network Ltd. – Segment focus

- 10.10 Kuehne + Nagel International AG

- Exhibit 79: Kuehne + Nagel International AG – Overview

- Exhibit 80: Kuehne + Nagel International AG – Business segments

- Exhibit 81: Kuehne + Nagel International AG – Key news

- Exhibit 82: Kuehne + Nagel International AG – Key offerings

- Exhibit 83: Kuehne + Nagel International AG – Segment focus

- 10.11 United Parcel Service Inc.

- Exhibit 84: United Parcel Service Inc. – Overview

- Exhibit 85: United Parcel Service Inc. – Business segments

- Exhibit 86: United Parcel Service Inc. – Key news

- Exhibit 87: United Parcel Service Inc. – Key offerings

- Exhibit 88: United Parcel Service Inc. – Segment focus

- 10.12 XPO Logistics Inc.

- Exhibit 89: XPO Logistics Inc. – Overview

- Exhibit 90: XPO Logistics Inc. – Business segments

- Exhibit 91: XPO Logistics Inc. – Key offerings

- Exhibit 92: XPO Logistics Inc. – Segment focus

11 Appendix

- 11.1 Scope of the report

- 11.2 Currency conversion rates for US$

- Exhibit 93: Currency conversion rates for US$

- 11.3 Research methodology

- Exhibit 94: Research Methodology

- Exhibit 95: Validation techniques employed for market sizing

- Exhibit 96: Information sources

- 11.4 List of abbreviations

- Exhibit 97: List of abbreviations

Tune in to Martech Cube Podcast for visionary Martech Trends, Martech News, and quick updates by business experts and leaders!